Manual Payroll in QuickBooks- How to use? (Steps)

Call us for instant help – We are available 24*7

Payroll features in QuickBooks are one of the most useful and important features offered by the software. It is used by many companies to manage the payroll activities of their organization. The payroll feature enables the user to create payroll, calculate payroll, and much more automatically. This feature can also be used manually, but many users do not know how to. This article is all about how you can employ manual payroll features. Different steps to enable the manual setup has been discussed in this article. Read the article to know everything about the manual payroll in QuickBooks and how to employ the same.

What Is Manual Payroll In QuickBooks?

Manual payroll in QuickBooks means making entries of every employee’s salary and other transactions manually. QuickBooks comes with an automatic payroll option as well. The automatic option is good if all your employees for work the same amount of time and have the same salary. However, if the salaries and work timings of your employees are different then you can choose the manual payroll option to avoid any errors or mistakes.

Information required by QuickBooks to Calculate Payroll

- The first thing needed is the details of the company. This includes the name, ID, address, tax ID number of the company.

- The next thing required is the details of the employee. It includes the basic details of the employee with the information thought which their payroll is decided.

- The last thing needed is the information about the expenses of the company which are related to the payroll.

Read more - How to resolve QuickBooks Payroll update errors?Steps to Follow to Enable Manual Payroll

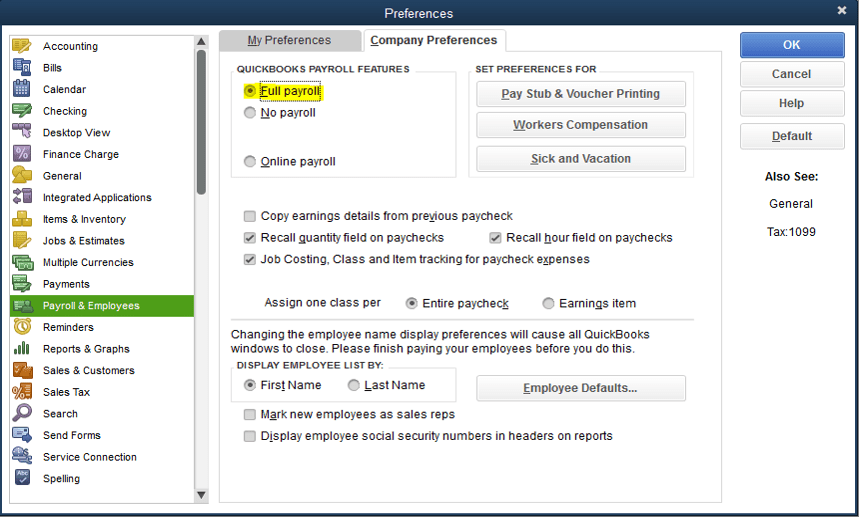

In QuickBooks, the payroll feature is enabled by default. In case you want to switch to the manual method, you will have to disable the payroll feature in QuickBooks. To enable manual payroll feature in QuickBooks, follow the step mentioned below:

- Look for the QuickBooks desktop icon on your system and run it.

- In the edit tab, look for the preference tab.

- In the preference tab, you will find an option related to payroll.

- In that option, you will have to choose the option with no payroll. This will disable the automatic feature and enable the manual feature.

Steps to Add Payroll Manually in QuickBooks

Once you have enabled the manual payroll feature in QuickBooks, the next steps are to add the payroll manually. Follow the steps mentioned below:

- In the QuickBooks window, you will have to click on the employee tab.

- In the window, you will see an option to edit the payroll of the employees click on that option.

- A new window will open up with a list of all payroll items with the name of the file and its type.

- In case, you want to enter a new entry in the payroll list, you will have to go to the new option in the payroll item list.

Read more - How to enter the QuickBooks Payroll service key?Schedule payroll

QuickBooks enables you to schedule your payroll. You can create a group of employees according to their payroll and how you are going to pay them. The QuickBooks software can calculate the payroll for the future. It enables you to pay your employees on time. To schedule payrolls, you will need to look for the option to schedule payroll and assign it to respective employees. The QuickBooks will then calculate the payment dates for every time.

Checking for payroll tax

Through, we always recommend you schedule your payments, but in case you haven’t, you can still make a payroll using QuickBooks. You can for your unscheduled tax. For say, you don’t have a subscription for QuickBooks payroll active and you have to pay a tax, you can pay it through QuickBooks. To make the payroll, you will be required to employ the liability check window. By filling it up, you will be able to pay the unscheduled payrolls easily.

Conclusion

Now, that you have enabled the manual payroll in QuickBooks, you will be responsible for the calculation of the taxes. The QuickBooks will only calculate the data that you will provide to it. If in case, any calculation goes wrong, you will be responsible for it. The best thing about the manual payroll in QuickBooks is that it is a cheaper option. You don’t have to pay for the subscriptions. The next thing is that the QuickBooks won’t allow you to prepare the tax forms if you have switched to the manual payroll in the QuickBooks. But, QuickBooks will assist you in preparing the reports.

We hope we have made it easier for you to now use the manual payroll in QuickBooks. There are chances that you can encounter different errors while trying to update the payroll in QuickBooks like error 15215 and error 15241. These errors can be fixed following some of the steps. We have mentioned all the necessary information that is required to know before opting for the manual payroll in QuickBooks.

Frequently Asked Questions

The main purpose of manual payroll is to keep track of employee’s working hours and leaves. In automatic payroll, the salary and working hours of all employees remain the same.

QuickBooks offers both automatic as well as manual payroll systems. Depending on your needs, you can use any of these payrolls.

In a manual payroll system, you have to enter the details of each employee manually, whereas in a computerized payroll system, you just need to enter the details of one employee or one formula and then the same procedure takes place for other employees as well.