what is QuickBooks Self Employed ?

[detailed guide]

Call us for instant help – We are available 24*7

“I am a freelancer and looking for appropriate accounting software that meets my requirements and budget. I have tried using some software but nothing matches QuickBooks self employed. This version of QuickBooks is specifically designed for freelancers or other individuals. I mean, I had heard about QuickBooks is the top accounting software, but I wasn’t sure if it was suitable for an individual. But after using this QuickBooks self-employed version, I’d be recommending this to everyone.”

Are you a freelancer, a contractor, or any individual looking for suitable accounting software to manage your accounts? QuickBooks self employed is the answer to all your problems.

What is QuickBooks Self Employed?

QuickBooks is software for businesses but this self employed QuickBooks version is specifically designed for people owning or working individually. This solution saves money and effort for self employed individuals.

A self employed person enjoys all the profit for themselves and bears the losses by themselves. They are responsible for all business decisions and are not answerable to anyone. Examples, Uber drivers, contractors, independent consultants, freelancers, etc. However, they still need to stay organized and keep a record of all finances. However manually you cannot achieve the level of accuracy that you actually need. Therefore, QuickBooks self employed is the best option to opt for.

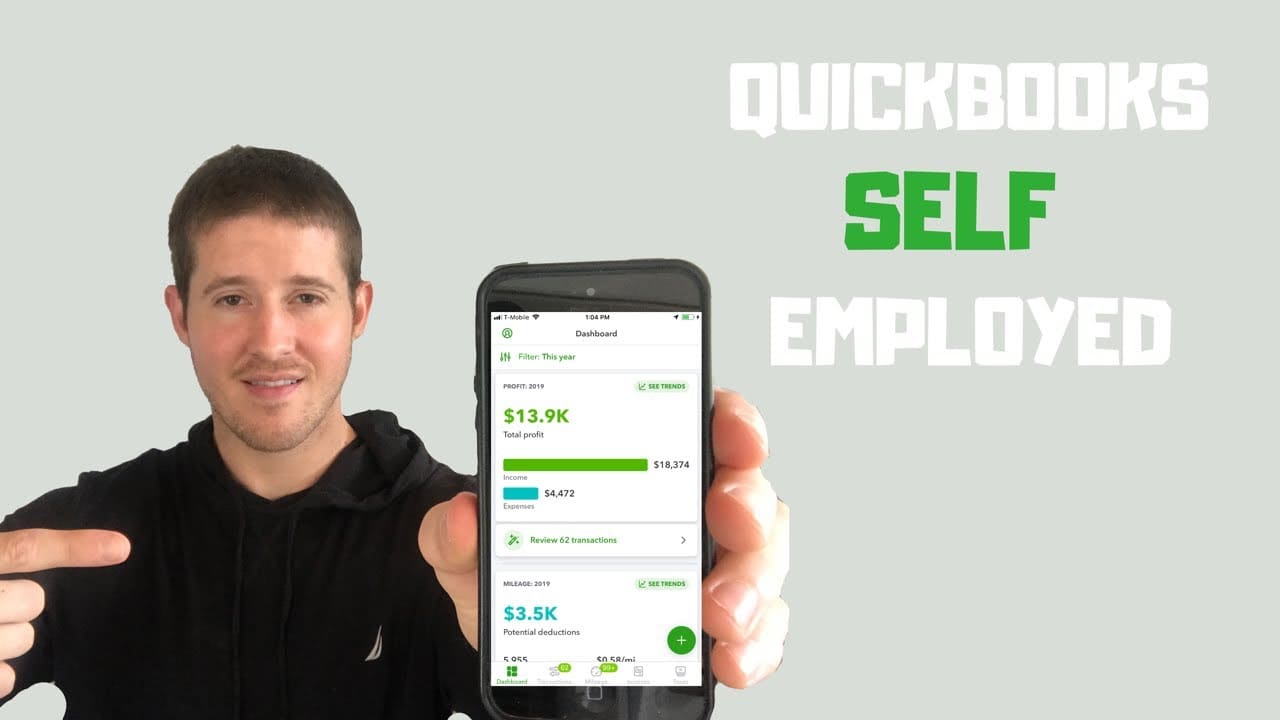

It lets you track your income, profits, losses, mileage, taxes, expenses, etc. by performing QuickBooks self employed login, you can concentrate on your prime operations while the software tackles all finances and bookkeeping.

Read More – How to activate QuickBooks Direct Deposit?

Features of QuickBooks Self Employed

Intuit launched three versions of QuickBooks self employed. You can select the one that fits your budget. Let’s have a look at each version along with the price and the features. So that it can be easier for you to make the decision and select the right one.

1. QuickBooks Self Employed Plan

The features of QuickBooks self employed are the basic accounting features added to all versions. These are:

Separate expenses for personal and business

QuickBooks self-employed offers to categorize your expenses into personal and business. It is important to keep personal expenses separate from business, especially for self-employed individuals. This even helps in filing the tax return.

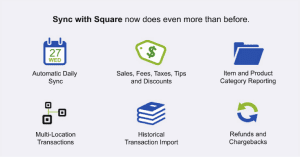

It also allows you to link your bank account and your credit card so that tracking expenses become easier and simpler. With the help of each transaction, QuickBooks self employed categories them and tracks them via the accounts you link.

Automatic mileage tracking

Only a person who travels for business and gets paid for it knows the importance of mileage tracking. With the help of QuickBooks self employed login, you can track every time you are traveling for work purposes. Accurate tracking helps in accurate payment. All you have to do is log into the QuickBooks self employed app on your mobile.

Taxes calculated quarterly

Being a freelancer, it must be a real headache to calculate the taxes every quarter. Self employed QuickBooks offers a solution for this. It automatically calculates these taxes on a quarterly basis. It does so by organizing your income and expenses for tax filing instantly.

Not only this, it reminds you of everything you owe and gives reminders before the due date so that you don’t miss the payment and prevent late quarterly tax fees.

Frame invoices

Another important feature of QuickBooks self-employed is that it lets you create, customize and send invoices directly to the client. It also enables you to accept online payments. You can create and customize invoice designs however you like. Moreover, if the customer delays the payment, you can use QuickBooks self employed login to remind them.

Track finances through reports

Knowing profits and losses as well as a whole summary of income and expenses is important even for an individual business owner. You can generate financial reports with self employed QuickBooks. These reports are profit and loss statements, etc.

The purpose of these reports is to provide information on income, taxes, expenses, money wed, etc.

Pricing plans

You can operate self employed QuickBooks on a desktop, tablet, or mobile only at $10 per month.

Read More - How to Fix Printing Problems in QuickBooks?2. QuickBooks Self-Employed Tax Bundle Plan

Along with the features of QuickBooks self employed, the tax bundle plan offers other additional features as well. Let’s have a look at them:

- Separate expenses for personal and business

- Automatic mileage tracking

- Taxes calculated quarterly

- Frame invoices

- Track finances through reports

Filing tax return

Filing tax returns is the real peeve for most freelancers. However, QuickBooks self employed login (tax bundle) includes one state and one federal tax return filing. You get much better tax filing with the software.

Pay taxes straight from the tax bundle

QuickBooks self-employed tax bundle offers another feature that makes life a little easier. It not only calculates your quarterly tax estimates but also files them for you. If this was not enough, it allows you to directly pay quarterly taxes from self employed QuickBooks.

Therefore, it does the math and all the effort. All you have to do is pay, and that too by using the app. Easy-peasy!

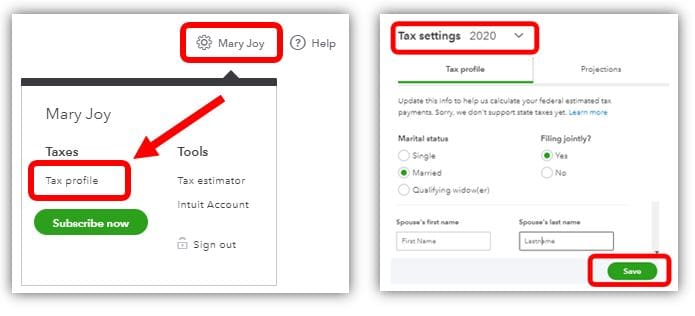

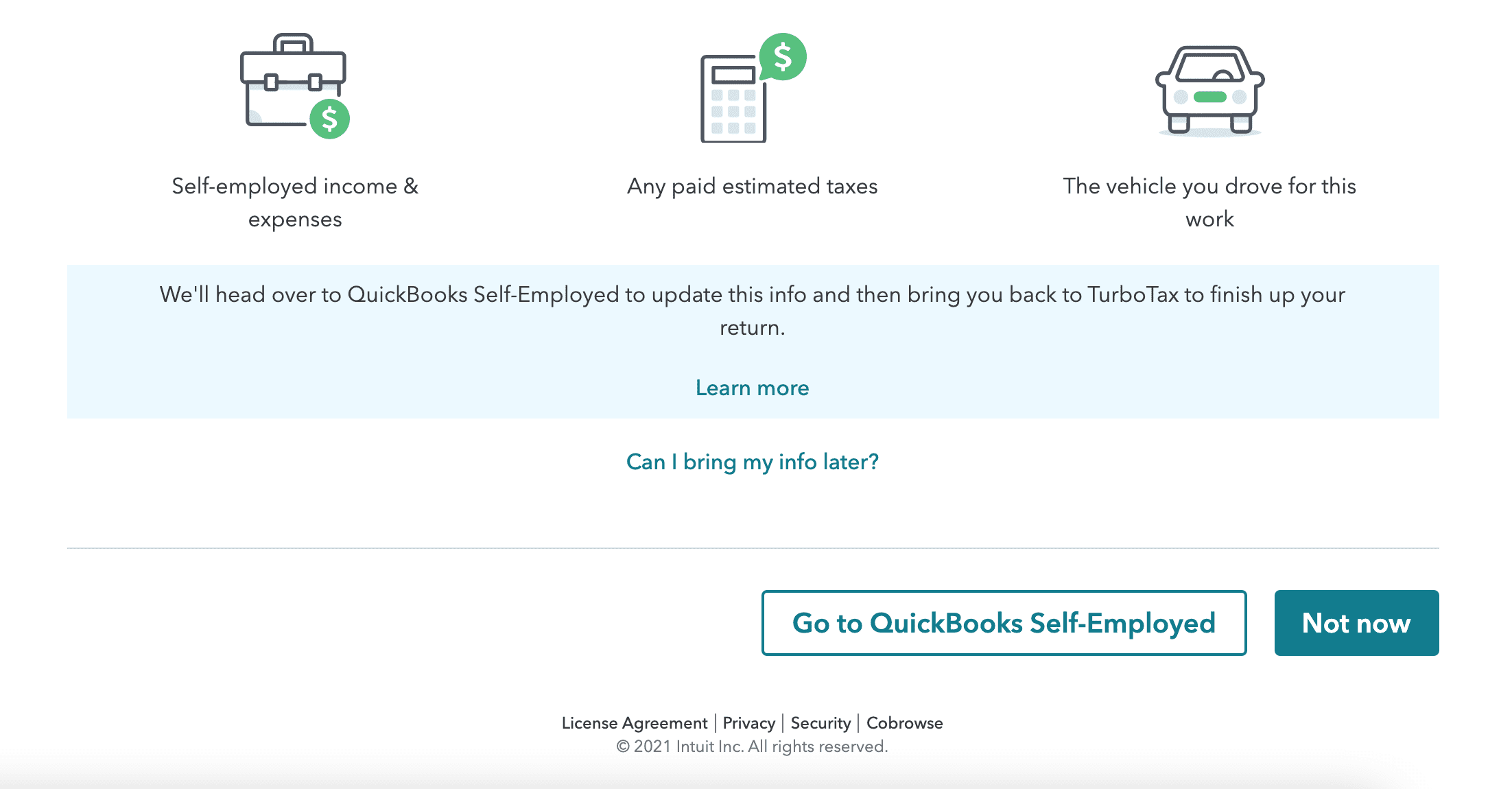

Integration with TurboTax account

A Turbo tax account is a tax filing account that most users use to file their tax returns. Self employed QuickBooks tax bundle offers to integrate the TurboTax account to make business income and tax tracking much easier and faster.

Pricing plan

Self employed QuickBooks tax bundle offers a plan of $12/month to be used on desktops, tablets, and mobile phones.

3. QuickBooks Self Employed Live Tax Bundle Plan

QuickBooks self-employed live tax bundle plan offers a huge variety of features. Along with the tax bundle self employed QuickBooks plan and the self-employed QuickBooks plan’s features, the live tax bundle plan offers additional factors as well. Let’s have a look at all:

- Separate expenses for personal and business

- Automatic mileage tracking

- Taxes calculated quarterly

- Frame invoices

- Track finances through reports

- Filing tax return

- Pay taxes straight from the tax bundle

- Integration with TurboTax account

Read More - How to merge vendors in QuickBooks?4. Get in touch with Chartered Professional Accountant

CPA and EA experts with more than 15 years of experience are available at your beck and call. Live tax bundle self employed QuickBooks provide access and consultation to these professionals whenever you want.

These professional accounts also provide all year-round assistance and guidance by looking at your reports. Whenever you want any doubts or questions, you get in touch with the team and they will provide you with a satisfactory answer.

By sharing issues with CPA and EA, you open the gates for a lot of satisfactory solutions for your issue.

Pricing plan

Self employed QuickBooks live tax bundle offers a plan of $17/month to be used on desktops, tablets, and mobile phones.

Pros And Cons QuickBooks Self Employed

Pros:

- You can categorize expenses as personal and business and track them with the app.

- Helps calculate and pay quarterly tax estimates.

- Gives reminders to avoid late tax quarterly fees.

- Allows you to track expenses and mileage from anywhere and everywhere, just by QuickBooks self employed login in your mobile phone.

- Integration with turbo tax account.

- Syncing with a bank and credit card makes tracking income and expenses much easier.

- User-friendly interface at a pocket-friendly price.

Cons:

- You cannot track unpaid bills.

- Although you can create invoices, self employed QuickBooks offer limited features of invoices.

- You have a profit and loss statement but not a balance sheet.

- No payroll account integration.

- It prompts a lot, which can be annoying.

- You will need to manually categorize certain entries or transactions.

- It does not offer a very wide variety of accounting and bookkeeping features. Therefore, you only have access to limited features.

Who Can Operate QuickBooks Self Employed?

QuickBooks self employed is not suitable for all. It is only suitable for a group of people, i.e. it is specifically designed for a certain community that we’re going to discuss further. To understand if self employed QuickBooks is ideal for you, keep reading.

- Freelancer: If you’re a freelancer, QuickBooks self employed login is your bookkeeping solution. It offers just enough features that a freelancer will and should be expecting from software like this. Furthermore, it is easy to use and requires literally no training at all.

- A sole proprietor like a contractor, uber driver, etc who is answerable to no one, uses their own funds to run the business, enjoys profits all by their own, and bears all losses alone can opt for QuickBooks self-employed. It offers to create invoices, estimating taxes, and filing tax returns. Many more such features will be suitable for your business.

- Remotely located business: Since QuickBooks self employed offers you to run the software from anywhere and everywhere simply by logging it into your mobile, this is a suitable and best accounting choice for you.

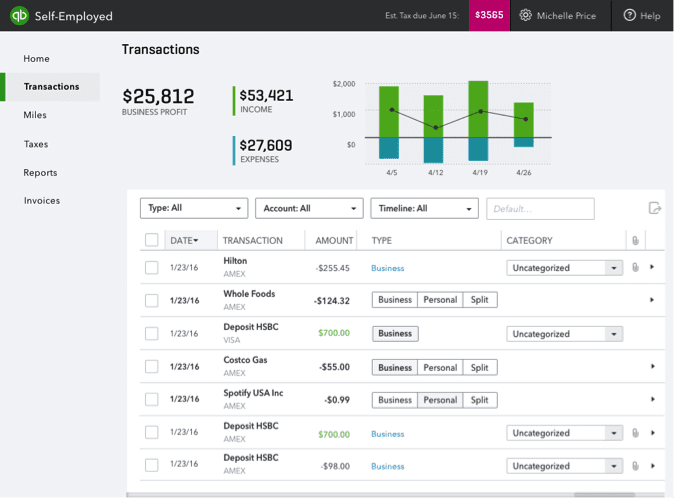

Read More - How to Fix Specified File can't be Open Error?Getting To Know The Interface of QuickBooks Self Employed

It is quite clear that QuickBooks self-employed has a user firefly interface. However, what’s the harm in familiarizing yourself with certain features before getting started? Let’s have a look at user interface of QuickBooks self employed:

- Taxes: With this feature in QuickBooks self employed, you can calculate, pay and file quarterly tax estimates.

- Expenses: Reviews all your expenses, personal and business.

- Invoices: With this feature, you can frame invoices for customers as per their requirements.

- Profit and loss: It is a report that reviews your income and expenses according to the date (monthly, weekly, yearly, quarterly, etc.) and presents you with the information of the same.

- Mileage: Helps track mileage accurately for calculating the payment as per distance traveled for business purposes.

- Accounts: Check and show the balance (present) in credit cards and all the accounts you have synced.

- Menu bar in left: It contains icons or names of every part of the program. You can simply click and navigate to any part you wish to.

Wrapping Up!

QuickBooks self employed is suitable for sole proprietors, freelancers, or individual businesses. Anyone who is answerable to one and bears all profits and loss all on their own is self employed individual. These individuals can opt for QuickBooks self employed to meet their accounting and bookkeeping needs. Having said that, the software offers enough features that will attract and be useful to this community of businesses. Tax estimates, invoices, expense tracking, report of profit and loss, etc. are the features that this software offers.

Moreover, it requires literally no training and is very affordable. If you are a freelancer or self-employed individual, you are going to love it.

Frequently Asked Questions

Q1: Do I have to pay for QuickBooks Self-Employed?

Answer – QuickBooks self-employed app is completely free of cost to download. However, in order to use all the features, you can buy monthly plans that are pretty affordable:

- Self employed plan- $10/month

- Tax bundle plan- $12/month

- Live tax bundle plan-$17/month

Q2: What is the difference between QuickBooks and QuickBooks Self-Employed?

Answer – On one hand there is QuickBooks, which is suitable for small to midsize businesses. It offers a huge variety of features including payroll accounting and much more. However, it is not suitable for a freelancer. That is when QuickBooks Self-Employed enters. It is suitable for freelancers, remotely working businesses, or self employed individuals. It is very affordable and offers just the right amount of features suitable enough for these businesses.